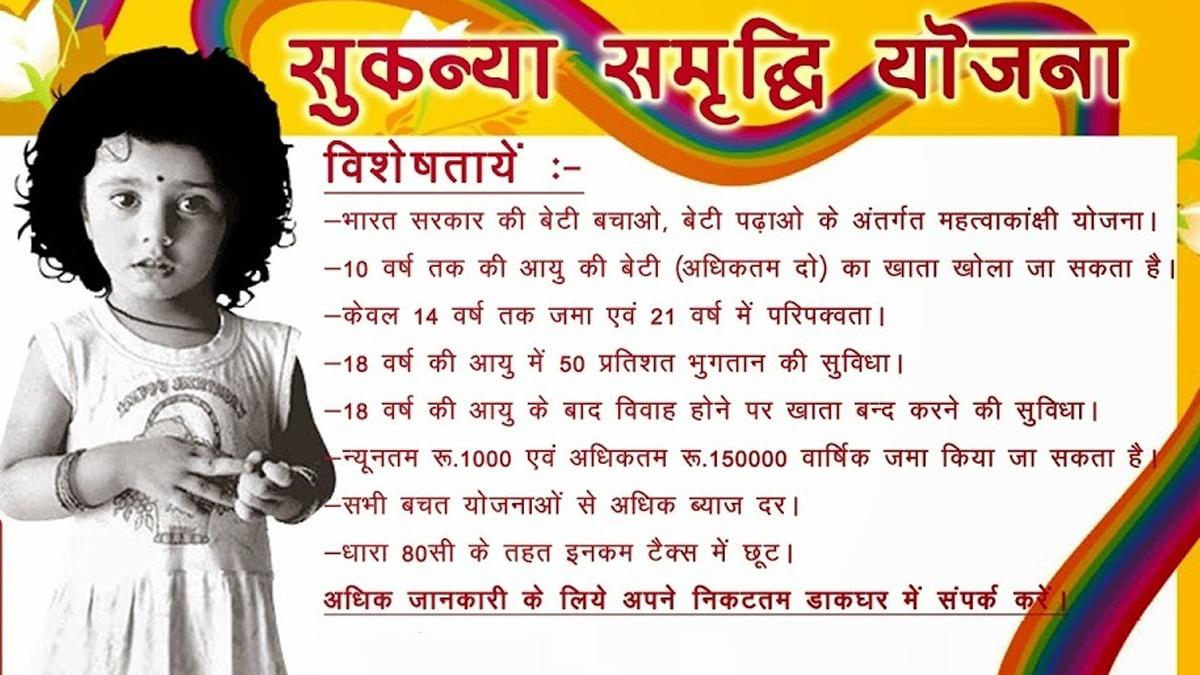

Start saving for your daughter’s future with Sukanya Samriddhi Yojana 2025. Get 8.2% interest, full tax exemption, and secure education and marriage expenses. Know eligibility, benefits, and how to apply online.

Sukanya Samriddhi Yojana 2025

| Feature | Details |

|---|---|

| Scheme Name | Sukanya Samriddhi Yojana (SSY) |

| Launched By | Government of India (under Beti Bachao Beti Padhao) |

| Current Interest Rate | 8.2% per annum (Jan-Mar 2025) |

| Minimum Yearly Investment | ₹250 |

| Maximum Yearly Investment | ₹1.5 lakh |

| Lock-in Period | 21 years from the date of account opening |

| Deposit Period | Up to 15 years from opening |

| Eligibility | Girl child below 10 years |

| Tax Benefit | Exempt under Section 80C (EEE status) |

| Partial Withdrawal | Allowed after 18 years for higher education/marriage |

| Where to Open | Post offices and authorized banks (SBI, HDFC, ICICI, etc.) |

What is Sukanya Samriddhi Yojana?

Sukanya Samriddhi Yojana (SSY) is a small deposit scheme launched by the Government of India for the benefit of the girl child. It encourages parents to build a financial corpus for their daughter’s future education and marriage. The scheme is one of the highest interest-paying small saving schemes and offers full tax exemption under the EEE category.

Sukanya Samriddhi Yojana Interest Rate 2025

- Current Rate (Jan–Mar 2025): 8.2% per annum

- Interest is compounded annually.

- Rates are revised by the Finance Ministry every quarter.

SSY currently offers the highest interest rate among all small savings schemes in India.

Key Features & Benefits of SSY 2025

- High Interest: 8.2% p.a., better than bank FDs or PPF

- Government Guarantee: Backed by the Ministry of Finance

- Flexible Investment: Start with just ₹250/year

- Supports Education Goals: Withdraw 50% after the girl turns 18

- Marriage Planning: Full maturity after 21 years

- 100% Tax-Free: Investment, interest, and maturity amount – all tax-exempt

Eligibility Criteria for SSY

- The account can be opened only for a girl child below 10 years.

- Only one account per girl is allowed.

- A family can open up to two accounts for two girl children.

- In case of twins/triplets, exceptions are allowed.

How to Open Sukanya Samriddhi Account?

You can open the SSY account at:

- Any post office

- Authorized banks such as SBI, HDFC, ICICI, Axis Bank, etc.

Required Documents:

- Birth certificate of the girl child

- Parent’s/guardian’s photo ID (Aadhar/PAN)

- Address proof (Utility bill/Aadhar/Passport)

- Passport-sized photo of the applicant

Also Read:

- Vahali Dikri Yojana 2025: ₹1,10,000 Assistance for Girl Child – Apply Online, Benefits, Eligibility

- Pandit Din Dayal Upadhyay Awas Yojana 2025 – Apply Online

- PM Kisan 20th Installment 2025 Date to Be Announced Soon: Full Details of Yojana, Status Check & eKYC

Sukanya Samriddhi Yojana Maturity Example

Let’s say you invest ₹12,500 per month (₹1.5 lakh per year) for 15 years:

| Year | Total Investment | Maturity Value |

|---|---|---|

| 15 | ₹22.5 lakhs | ₹70+ lakhs |

- This makes SSY one of the best long-term investment + savings plans for a girl child.

Tax Benefits Under SSY

Sukanya Samriddhi Yojana is among the few schemes that offer EEE tax status:

- Exempt at investment (under Section 80C)

- Exempt on annual interest

- Exempt on final maturity amount

FAQs – Sukanya Samriddhi Yojana 2025

Can I open a Sukanya Samriddhi Account online?

You can download the form online but must submit it offline at a post office or authorized bank.

What happens if I miss a year’s payment?

The account will be deactivated. You can reactivate it by paying a penalty of ₹50 plus the minimum deposit of ₹250.

Can I withdraw money before maturity?

Yes, after the girl child turns 18 years old, up to 50% of the balance can be withdrawn for higher education or marriage.

The Sukanya Samriddhi Yojana (SSY) is a government-backed savings scheme aimed at securing the financial future of girl children in India. Launched under the Beti Bachao, Beti Padhao initiative, SSY offers attractive interest rates and tax benefits, making it an ideal investment for your daughter’s education and marriage expenses.